Our services

SOCIAL INVESTMENT STRATEGY AND FUND DESIGN

We have worked with funders including leading social investors and foundations to help develop and design social investment fund concepts.

We can help define the fund thesis, determine the target investee groups, identify any non financial support that that may be required and outline the investment products / lending terms.

RAISING SOCIAL INVESTMENT

We guide our clients through the investment raising process by developing investor materials, building financial models and managing investor communications.

We work with organisations of all sizes, offering the same level of dedication for initial investment raises as more complex funding structures including social impact bonds.

IMPACT MEASUREMENT

For both new projects or ventures and longstanding organisations, developing a new Theory of Change can be a helpful exercise to redefine and articulate impact goals.

Adopting a needs-based approach, we work collaboratively with our clients and their beneficiaries to build an effective impact strategy including a framework for measuring impact in real numeric terms.

RESEARCH

For clients looking for a deep dive into a specific issue, we have a comprehensive research offering. This could include survey design to gauge programme effectiveness, market research or direct stakeholder engagement to challenge prevailing assumptions.

We deliver both extensive reports that can withstand academic challenges and more succinct outputs for marketing and wider dissemination.

Many of our projects span workstreams and are highly customised. If you require support not outlined above, our consultants would welcome a conversation.

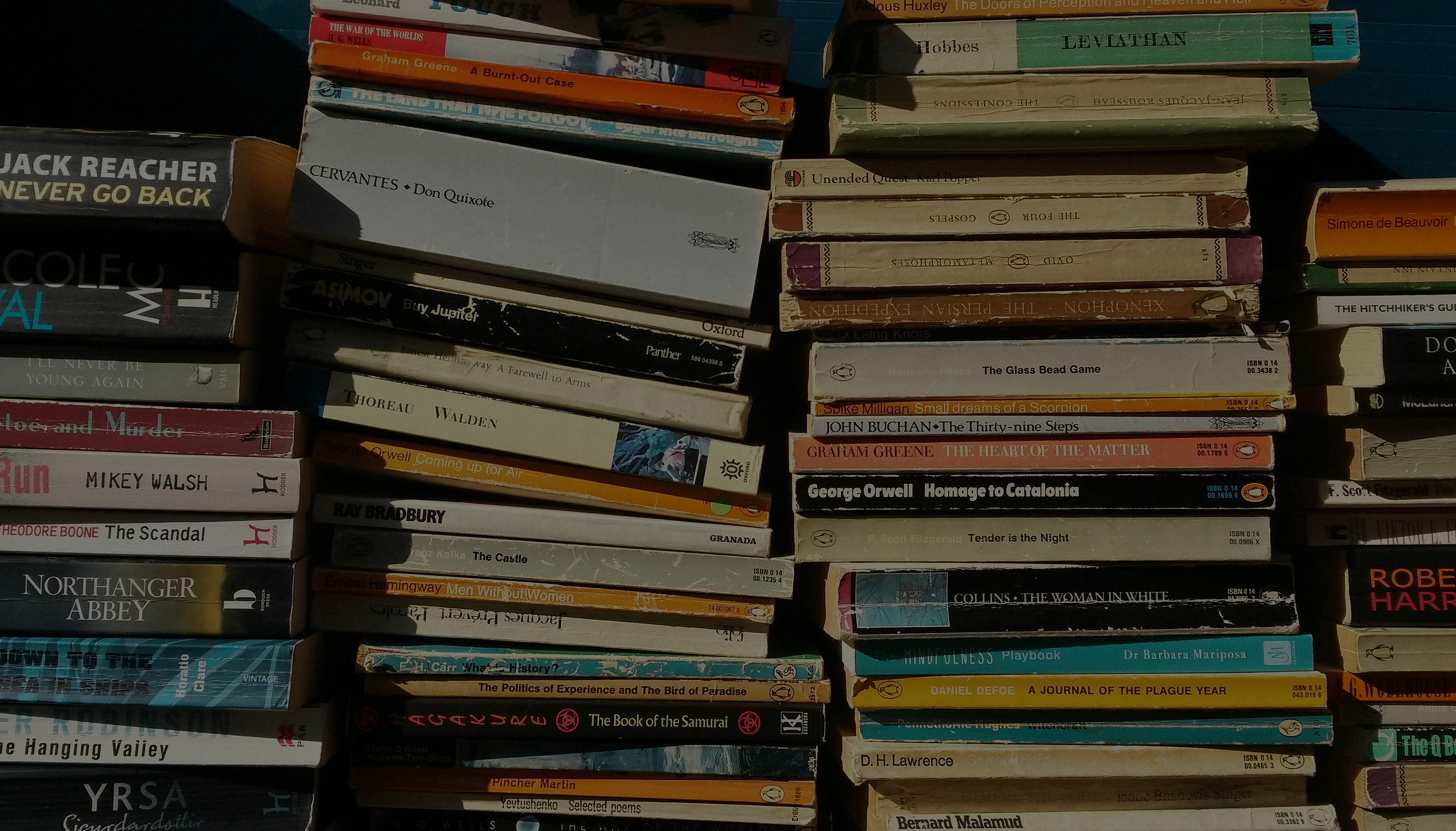

A selection of our clients

Our team

Tej Dhami

Managing Director

Talk to Tej about fund design and due diligence, accelerator and incubator programme design and research projects.

tej@thechangecoefficient.com

More about Tej

Tej founded the Change Coefficient in 2019 having previously been Managing Director at Numbers for Good. She is a finance and enterprise development expert with a career spanning investment banking, equity fund management and social enterprise incubation across developed and developing markets. She has funded, supported and built social enterprises in multiple geographies. Tej has helped organisations raise over £5m of capital through equity and debt. She successfully leverages her experience as an investor to help clients build strong investment cases and develop robust risk mitigation strategies. Tej is passionate about applying the principles of finance to build collaborative solutions to today’s most pressing problems.

Roshni Arora

Lead Consultant

Talk to Roshni about theories of change, impact measurement frameworks and any general enquiries.

roshni@thechangecoefficient.com

More about Roshni

Roshni is an experienced social investment and impact consultant having held previous roles at Sonnet Advisory and Impact and Numbers for Good. She has helped organisations raise finance from social investors by constructing financial models and writing investor materials and has worked with clients to better understand, measure and communicate their impact by developing theories of change and impact measurement frameworks. Roshni is also skilled at building social value models for organisations looking to demonstrate their impact as financial savings for the public sector or benefits to the wider economy. Past clients include NHS England, Grosvenor Group and the Imperial War Museum. Roshni is passionate about using her diverse skillset to enable clients to amplify their impact.

Mark O’Donnell

Investment Consultant

Talk to Mark about investment raising, capital structures and business plan development.

mark@thechangecoefficient.com

More about Mark

Mark is a strategy and financing consultant. He has helped enterprises assess their funding needs, improve their business plan, research markets/competition, and audit & rebuild their financial models. Previously, Mark led the Media & Online equity research team at JP Morgan, spending 12 years researching and assessing the strategy, industries and valuation of publicly listed companies, and helping on many equity fund raisings, mergers and acquisitions. At FOXTEL (Australia’s largest pay TV provider), Mark worked in strategy and corporate development, during its transition from analogue to digital. He has implemented strategic initiatives in areas as diverse as marketing to engineering.

Karen Dsouza

Impact Consultant

Talk to Karen about social enterprise development in India, enterprise incubation and impact assessment.

karen@thechangecoefficient.com

More about Karen

Karen is an impact and evaluation consultant. As an incubation associate and latterly monitoring and evaluation consultant for Unltd India, Karen worked with a diverse array of social enterprises. She was responsible for accountable and efficient collection, analysis and reporting of the impact of the organisation and its social entrepreneurs. As a coach she also worked directly with social entrepreneurs helping them build their theories of change and develop viable business models. Her previous roles include business development and strategy at UTV and Bank of America. Karen is passionate about the potential for social enterprises to drive sustainable social change and believes effective data collection and analysis can drive ever improving social outcomes.

Click below for some examples of our work including case studies of successfully completed projects and our industry leading reports.